Ever since the inception of digital transactions, PayPal has stood as a towering beacon in the financial domain. Its convenience, security, and global outreach have made it a preferred choice for many. But here’s a burning question – Can you actually open and manage a PayPal account without a bank account? The answer may surprise you. Let’s dive in!

The Basics of PayPal

Before we jump to our main topic, it’s essential to understand what PayPal is and how it typically operates. For those who’ve been living under a digital rock, PayPal is a global payment system that allows individuals and businesses to send and receive money. Typically, you would link a bank account or a credit card to facilitate these transactions.

Why People Prefer PayPal:

- Safe and Secure Transactions;

- Global Acceptance;

- Easy to Use Interface;

- Efficient Customer Support.

Setting Up PayPal Without a Bank Account: Is it Possible?

Yes, it is! While it’s unconventional, PayPal does allow you to set up an account without linking a bank account. Here’s how:

Sign Up for an Account

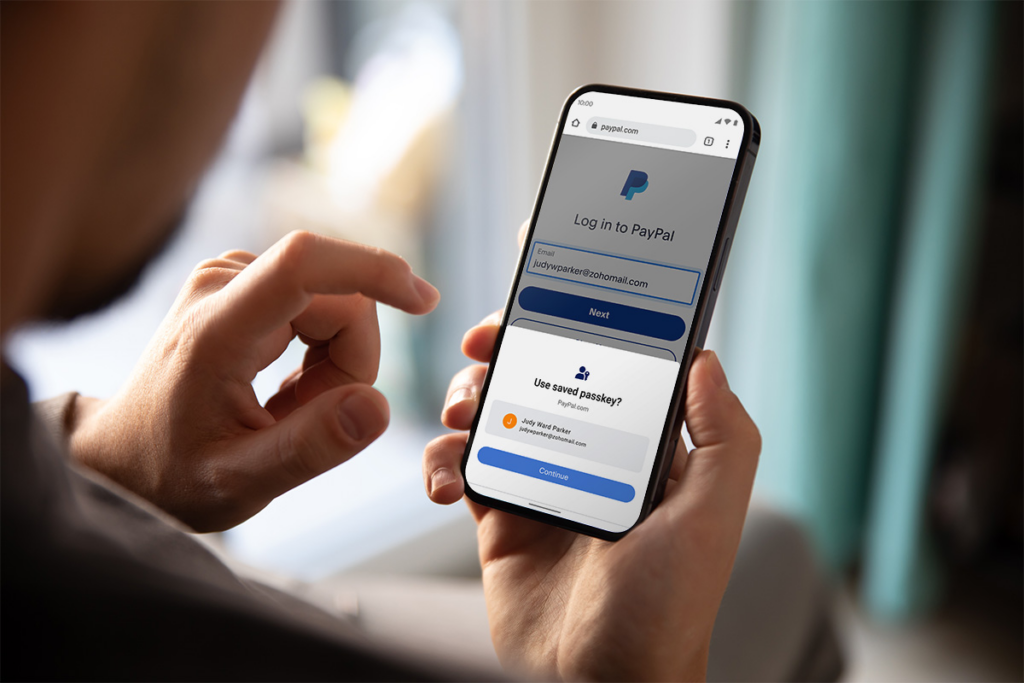

Visit the PayPal website or app, and choose “Sign Up.” Select the account type you want – Personal or Business.

Provide Necessary Details

Fill in your personal information but skip the bank account section.

Verification

PayPal will still require verification. In lieu of a bank account, you can use alternative methods like linking a credit card or using PayPal balance.

Benefits of a No-Bank-Account PayPal

- Privacy: Without a bank link, your transactions remain discreet;

- Simplicity: Sometimes, fewer links mean fewer complications;

- Perfect for Non-bankers: Not everyone has a bank account. This is a boon for them.

Limitations and Hurdles

Nothing’s perfect. Here are a few challenges of using PayPal sans bank:

- Withdrawal Restrictions: Without a bank account, withdrawing money from PayPal can be a tad challenging;

- Limited Features: Some advanced features might be off the table;

- Verification Hiccups: Expect some extra steps for verifying your identity.

Alternative Solutions for Withdrawals

So, how do you get your money out?

- PayPal Cash Card: A physical card that lets you spend your PayPal balance;

- Transfer to Friends: Send money to a trusted friend or family member who can then return it to you via another method;

- Purchase Online: Use your PayPal balance for online shopping and transactions.

Safety Tips: Navigating PayPal Without a Bank

Without the safety net of a bank, you need to be extra cautious:

- Strong Password: Keep hackers at bay;

- Two-Factor Authentication: An extra layer of protection;

- Monitor Transactions: Regularly check your PayPal activity.

Comparing: PayPal With Vs. Without Bank Account

| Feature | With Bank Account | Without Bank Account |

|---|---|---|

| Ease of Withdrawal | High | Moderate |

| Features Access | All | Limited |

| Privacy | Moderate | High |

| Verification Complexity | Low | Moderate |

Exploring Other Alternatives to PayPal

While PayPal reigns supreme in the world of online transactions, it’s by no means the only player in the game. If you’re venturing into the world of digital payments without a bank account, it’s worth exploring other platforms as well. Here’s a brief rundown:

Venmo

Owned by PayPal, Venmo is tailored more for personal use. It’s simple, user-friendly, and great for splitting bills or paying friends. While it primarily works with bank accounts, you can keep and use a balance without one.

Skrill

An international transfer favorite, Skrill allows for transactions in multiple currencies. While linking a bank can enhance your experience, it’s not mandatory. They also offer a prepaid card.

Google Pay

While Google Pay mainly operates by linking cards, it does maintain a balance system. For those occasional transactions or for holding onto refunds, you can use Google Pay sans bank.

Cash App

Square’s Cash App is another formidable player. It’s user-friendly, and while linking a bank makes things smooth, you can transact without one, especially if you have their Cash Card.

List of Features for these Alternatives:

| Platform | Bank Required? | Prepaid Card Available? | Multi-Currency Support? |

|---|---|---|---|

| Venmo | No | Yes | No |

| Skrill | No | Yes | Yes |

| Google Pay | No | No | No |

| Cash App | No | Yes | No |

Conclusion

While using PayPal without a bank account might sound like venturing into uncharted waters, it’s entirely feasible and offers its own set of advantages. For those who prioritize privacy or simply don’t have a bank account, this option provides flexibility. However, always stay informed and cautious to ensure a smooth PayPal experience.

FAQs

Yes, you can link it anytime after the initial setup.

Generally, no. But always check the latest PayPal fee structures.

Credit cards or a significant PayPal balance can help in verification.

There might be, especially if you remain unverified.

It’s available in many regions, but not everywhere. Check PayPal’s official site for availability in your country.